Did you just receive your new Chase credit or debit card? Before you use it, you need to clearly verify it. If you’re not sure how, don’t worry. This simple guide covers everything you need: how to verify your card through chase.com/verifycard activate, using the app (Chase Verify card on app), and what to do if you run into problems like Chase com verify card not working.

Let’s clearly go step-by-step, keeping it simple so anyone can easily follow along.

Why Do You Need to Verify Your Chase Card Clearly?

First things first—why must you verify your card? Simple: Chase clearly needs to confirm you received your card safely. Verification protects you from fraud and clearly ensures your card works correctly.

It only takes a few minutes and makes your card ready to use.

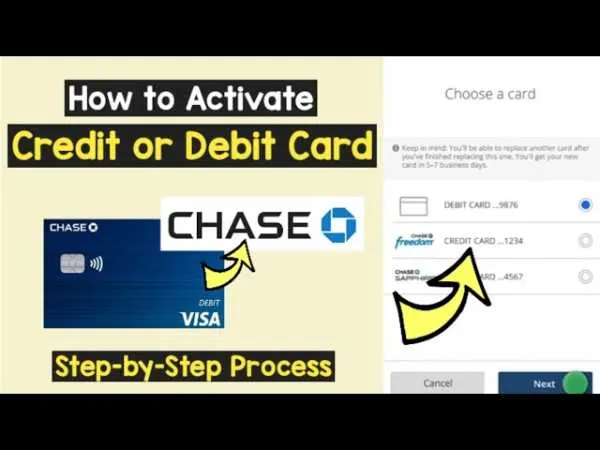

How to Verify Your Chase Card Clearly (Simple Methods)

Chase offers three clear ways to verify your card:

- Online at chase.com/verifycard activate

- Using Chase mobile app

- By phone (Chase com verify card phone number)

Let’s go through each method clearly.

Method 1: Chase.com/verifycard Activate Clearly Explained

Simple chase.com/verifycard Instructions:

Follow these clear steps:

- Go to Chase Website:

Open your browser and clearly type chase.com/verifycard activate. - Log in to Your Account (Chase com verify card login):

Enter your username and password clearly. - Enter Your Card Number (Chase com verify card number):

Carefully type the 16-digit number on your new card. - Confirm Your Identity:

Clearly answer the simple security questions or enter the code sent to your phone. - Finish and Activate:

Click “Activate,” and you’re done! Your card is ready to use.

Method 2: Chase Verify Card on App (Easy Steps)

Prefer your phone? Use the Chase app clearly and easily:

Clear Steps to Activate Using Chase App:

- Download the App:

If you don’t have it, search “Chase” in your app store and download. - Log In to Your Chase App:

Enter your login details clearly. - Find “Verify Card” Option:

Clearly tap on “Account” or “Menu,” then choose “Verify Card.” - Enter Card Information (Chase activate card number):

Clearly type your card number into the given box. - Submit:

Follow simple on-screen instructions. You’re all set!

Method 3: Verify Your Card by Phone (Chase com verify card phone number)

Prefer talking to someone clearly? Use Chase customer service phone number:

Easy Steps for Phone Activation:

- Find Chase com verify card phone number:

Usually, this number is printed on a sticker on your new card. If you lost the sticker, clearly check the Chase website or app. - Call the Number:

Dial the number clearly. - Follow Instructions:

Answer simple security questions, enter your card number clearly, and listen carefully. - Activate Clearly:

After confirming your details, your card clearly activates immediately.

also read : – Vidnoz AI: Easy Guide to Pricing, Features, and How to Use It

What if Chase com verify card Not Working?

Sometimes, things don’t go smoothly. Maybe you face issues like “Chase com verify card not working.” Don’t worry. Here’s how you can clearly fix it:

- Check Your Internet:

Ensure your connection works clearly. - Double-Check Details:

Clearly re-enter your card number or login details carefully. - Clear Browser Cache:

Sometimes, your browser needs clearing clearly. Try that first. - Use Another Method:

If the website isn’t working, clearly try using the app or phone instead. - Call for Help:

If nothing works, clearly call Chase’s customer support. They quickly and clearly assist you.

Chase.com pros and cons

Pros

Big, Trusted Bank: Chase is one of the largest banks in the U.S. People know the name and trust the brand. Your money is safe and insured.

- Many Services in One Place: You can do banking, get credit cards, loans, investments, and use financial tools—all on one website.

- Easy Online Banking: The website and mobile app are simple to use. You can check balances, transfer money, pay bills, and deposit checks online.

- Strong Security Features: Chase uses encryption, two-factor logins, and you get alerts for suspicious activity. This helps keep your accounts safe.

- Branch and ATM Access: Thousands of ATMs and branches across the country make it easy to get cash or talk to staff.

- Good Rewards and Bonuses: Many Chase credit cards offer cash back, points, or sign-up bonuses if you qualify.

- Fast Payments: Using digital payments or contactless cards is quick and usually very smooth.

Cons

Fees: Some accounts have monthly fees. There are also fees for overdrafts, wire transfers, and using out-of-network ATMs.

- Customer Service Issues: Some people say wait times can be long, and getting help with special problems can take time.

- Not Highest Interest Rates: Savings and checking accounts at big banks like Chase pay low interest compared to some online or local banks.

- Tech Problems Happen: On rare days, sites or apps can go down for updates or crash. Always keep a backup plan just in case.

- Limits and Rules: Some online features have caps—like limits on daily transfers or spending with contactless cards.

- Privacy Concerns: Like other big banks, Chase collects lots of user data for marketing, so read privacy policies before sharing info.

Common Questions about Chase.com Verify Card (FAQs)

Can I verify my Chase card without logging in?

Usually, clearly logging in is required. Chase needs to confirm it’s really you.

What if I lose my Chase activate card number?

Clearly call Chase customer support immediately. They’ll help quickly.

How long does card verification take?

Usually, verification is instant and clearly takes only a few minutes.

Is the Chase app safe to verify my card?

Yes, the Chase app is safe, clearly secure, and easy to use.

Can I activate someone else’s Chase card?

No, clearly only the card owner should activate their card.

Safety Tips for Chase Card Verification Clearly

Always keep safety in mind clearly:

- Never Share Card Details:

Only enter your details clearly on official Chase website or app. - Use Official Chase Contact:

Always clearly confirm you’re using official Chase phone numbers or websites. - Secure Internet Connection:

Verify clearly over secure internet connections. - Keep Personal Info Safe:

Never clearly share passwords or sensitive details with anyone.

Tips to Remember Clearly When Using Chase Card Verification

- Clearly bookmark the official activation page (chase.com/verifycard activate).

- Clearly keep your login details safely noted somewhere private.

- Regularly check clearly for updates or notifications in your Chase app.

- Clearly keep Chase’s customer support number handy for quick help.

Why Chase Makes Card Verification Clearly Important?

Chase clearly uses verification to protect you from fraud and misuse. When you verify your card, Chase confirms clearly that your card reached the right person—you.

Verification is quick, easy, and clearly ensures your card works safely and smoothly.

What Makes Chase Card Verification Simple?

- Clearly easy-to-follow instructions online.

- Quick verification clearly through phone or app.

- Excellent customer support if you face issues.

- Clearly no complicated steps or technical confusion.

Final Thoughts: Clearly Verify Your Chase Card Quickly and Easily

Now you clearly know exactly how to verify your Chase card. Whether you use chase.com/verifycard activate, Chase Verify card on app, or the Chase customer support phone number (Chase com verify card phone number), verification is easy, quick, and clearly safe.

Don’t worry if you face issues like Chase com verify card not working. Chase support clearly helps you quickly resolve any problems.

Clearly verifying your Chase card means you start using it immediately without stress. Follow the easy chase.com/verifycard instructions provided, use the Chase app, or call Chase if needed. Your card clearly becomes active quickly, ready for daily use or special purchases.